Open Doors, Shady Guests: International Political Circumstances and the Expansion of Egypt’s Informal Economy

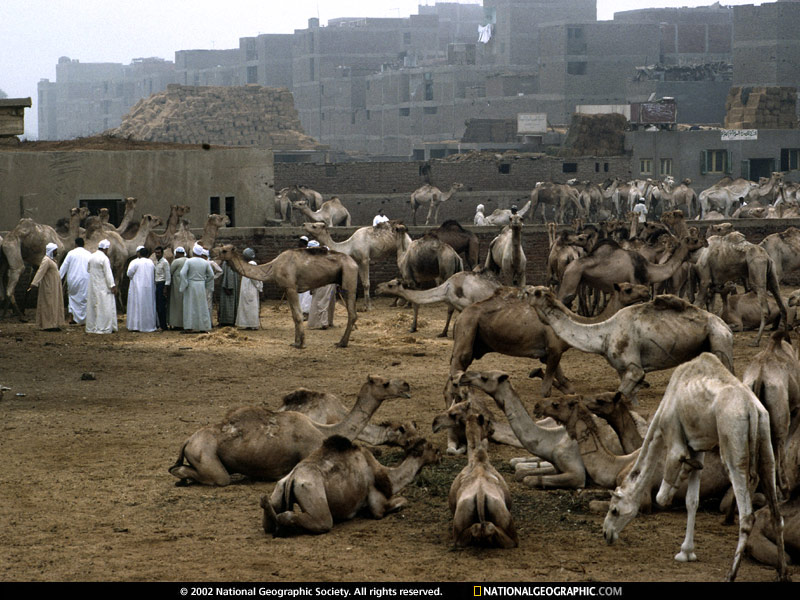

Early every morning, as Cairo comes to life and shakes slumber from its frame, so do scores of entrepreneurs who know that a new day is a new opportunity for a quick buck. Commuters bustle through city streets as vendors set up shop, offering homemade delights for an early morning bite, and tuk-tuk drivers start their engines to welcome workers with somewhere to be. The city lives, the city breathes. For even if these ambitious entrepreneurs make a pittance at the end of the day behind the lunch counter or the wheel of a motor vehicle, at least they know they pocket every cent of their keep. They remain at work in the informal economy.

The Shadow Trades.

Beyond the purview of government oversight, Egypt plays host to a vast informal economy that, as described by Peterson (2009), consists of “‘work’, licit or illicit, that is outside of formal market transactions”, most notably government regulation and taxation. Equating to about 40% of its GDP (EzzEldeen), “[t]he informal economy comprises those economic activities that circumvent the costs and are excluded from the benefits and rights incorporated in the laws and administrative rules covering property relationships, commercial licensing, labor contracts, torts, financial credit and social systems (Vuletin 2006). ” The informal economy may also be counted as part of a wider Egyptian “hybrid economic model” (Vuletin), with formal industry and a major destination for expatriate remittances who find work in the Persian Gulf, totaling at 10% of Egyptian GDP in 2019 (Soliman 2020). In the comparative absence of vast oil reserves, the latter revenue stream remains a key factor in continual Egyptian economic viability among its regional neighbours. Nevertheless, the informal economy only continues to grow, outpacing the formal economy in real growth by 1% per year (Soliman), further underlining the importance of its study.

The informal economy exists in the shady corners of Egyptian socioeconomics where the state has routinely failed at providing adequate social services and working conditions for about 63% of its poorest citizens (Soliman). To the extent that they work independently regardless of state assistance, then, it may be seen as a function of people doing what they must, providing for their families in any way that they can. This, of course, prompts an important distinction between the informal economy that produces legal goods and services through illegal means, i.e. without government taxes or regulation, in contrast to black markets that produce wholly illegal goods and services. Peterson further designates the type of informal economy that matches that of Egypt; rather than “combat economies” that fund insurgency in times of war and “criminal economies” with personal profit motives through explicitly illegal revenue streams, informal economies like that of Egypt are more like “coping economies”, which see activity in simple times of need, for keeping mouths fed (Peterson 35-36). It should be noted, however, that these categories are not mutually exclusive, as shown by Levitt (2021) in their exposition of Lebanese militant group Hezbollah’s provision of social services in Lebanon through institutions of health, religion, education and the like where many voters know the government cannot adequately provide them, and Amal—its allied political party—can. Given Hezbollah’s inherent militant Shi’a widespread allegations that Hezbollah an informal economy may be classified according to criminal and insurgent traits (Levitt). Regardless of exact type, however, Peterson effectively frames the causes and long-term effects of the informal economy, that “phenomenal growth in informalization profoundly complicates conventional ways of understanding economics, the legal status of various economic transactions, and the societal implications of reducing formal regulation of economic activities. A general observation is that the power of governments, presumably serving public/societal interests, is being ceded to the power of market authorities, presumably serving the interests of private capital” (Peterson 40).

The Cost.

While many are quick to underline the positive factors in the informal economy’s existence, namely that many working citizens will indeed work however they must to provide for their families and communities, the informal economy’s non-compliance with tax and regulatory standards carries a number of societal detriments. EzzEldeen notes the informal economy’s general non-consideration of established health and safety standards, making for subpar and even dangerous goods and services. Customers, in turn, have no legal recourse for product deficiencies. Also, national economic policy cannot be properly prescribed if a large proportion of GDP is untaxed, with businesses operating independently, as the informal economy’s integration into taxed Gross National Product (GNP) can help identify poor communities and make for better-prescribed policy more suited to their needs. On the same subject, it must be noted that an estimated 85% of small and medium-sized businesses (SMEs) are informal to begin with, making them the frequent loci of economic integration policy. In addition, in situations where untaxed enterprises are more profitable than registered enterprises for that reason, market competition is wounded, with customers bearing the burden of higher prices as a result. If Egypt’s current economic strategy under Egypt Vision 2030, its economic strategy to be fulfilled by the aforementioned year, hopes to build a “Robust Economy” as promised by Goal 3, economic authorities must work to integrate the informal economy for the betterment of far more Egyptians than ever before.

In keeping with this vision, this essay considers Egypt’s historical domestic economic policy and international political circumstances in concert. To wit, that their interplay over time has allowed the informal economy to proliferate, domestic economic policy reacting to international political circumstances, as state retreat from special services has allowed the informal economy to flourish for those who live and work in the underbelly of Egyptian society.

1967-77: The Shrinking State.

Along with that of its Arab allies, Egypt’s disastrous defeat in the 1967 Six-Day War with Israel was bad enough; the resulting inflation of the Egyptian pound (LE) only guaranteed the nation’s slip from the frying pan into the fire (Soliman). Sequestering a major sum to rebuild its ravaged air force, the Egyptian government under President Gamal Abdel Nasser could not afford wages to rise, at which point national poverty was at 44%. Under Anwar Sadat, the nation negotiated a deal with the World Bank and the IMF for debt restructuring by the end of the 1973 Yom Kippur War. The agreement compelled Egypt to slash food and oil subsidies, leading to a price spike and riots in response to both. Participants in the 1977 Bread Riots, as they became known, have been largely identified by Soliman as mostly state employees and wage labourers in poor suburban areas; precisely the types of labourers with future experience in the informal economy. Commenting on the severity of these original service cuts, Weinbaum (2006) observes that “In finally giving in to IMF demands as a concession to international creditors, including Saudi Arabia, Egypt paid a high political price. [...] The Sadat regime very nearly toppled before the increases were rescinded (215).” Recalling our thesis, we may analyze these events in terms of international affairs affecting domestic economic policy: when Egypt’s wars with Israel resulted in major currency crises, the resulting IMF/World Bank loan agreement saw major state retreat from social service provision, resulting in pushback from those who were unready to lose state assistance, though eager to provide in any way they could.

1977-81: The Open Door.

Using Peterson’s analysis of globalization as a tool of elites to protect the interests of powerful states and their institutions, we may observe that the common neoliberal regime prompts industrial deregulation, allowing for more unregulated activity that ultimately pays no taxes on its output. By extension, deregulation also prompts a smaller public sector workforce and social service provision through public means. In Peterson’s own words, “...neoliberal policies are linked to explosive growth in informal activities and unregulated global financial transactions (38).” Thus, President Anwar Sadat’s neoliberal-inspired economic policy of Infitah (Open Door), of state retreat, deregulation, and domestic and foreign private investment, reliably proved a boon to the informal economy’s expansion from the mid-1970s. Sadat wanted private investment from both domestic and foreign sources, converting Egypt to an export-oriented economy for a competitive edge in the global economy (Weinbaum). With the Gulf oil boom opening the lucrative remittance market around the same time, Infitah-based liberalization soon allowed for sufficient capital for major profit in sectors such as construction, service and transportation. However, workers in these sectors have since complained of bad jobs, with low productivity, considerable safety risks and little social mobility. In addition, these sectors are widely known for subcontracting informal labour. This phenomenon, of eventual administrative abdication over working conditions and business practices, continued through the rule of Hosni Mubarak, as the informal economy grew by 1% every year from 1980 to 2012. As the Egyptian government grew satisfied that private firms were producing more with less formal labour, and that social services were provided by such private agents as Islamic charities and neighbourhood organizations, the government’s wilting influence in the labour market extended to civil society. In the wake of Infitah, the informal economy went from providing individual labor jobs to allowing for entire factories and businesses that paid far less than what they owed in taxes. The notion that Infitah and its domestic effects were a response to international incentives is also plain here: begun in particular response to the economic aftereffects of an international war with Israel, Infitah highlighted the newfound influence of international lenders, such as the IMF, and investors that benefited from neoliberal economic policy for their continued investment in Egyptian industry. By the early 1980s, Weinbaum notes, Egypt was “one of the world’s most economically dependent countries” (206) with about 20% of its entire food supply imported. As a result, Schechter (2008) observes, “The hidden economy became a part of Egyptian daily life on every level in employment, housing, shopping, or dealing with local and national government, and it impacted on household politics and intimate family and gender relations as well as society and the economy at large.”

1981-2011: Shadows Lengthen.

Well into Hosni Mubarak’s presidential tenure, reforms in the vein of Infitah showed few signs of abatement. In the mid-2000s, Egypt launched a new round of structural adjustment under Mubarak’s son Gamal’s auspices, including mass privatization, layoffs of low-skilled workers, devaluing the pound, removing food and oil subsidies, and hiking taxes (Soliman). As with Infitah thirty years before, these lead to real GDP growth that simply did not trickle down to the poorest Egyptians. Poverty increased and informal output neared 40% of GDP, where it remains today (EzzEldeen). By 2011, since the government had not been an essential job creator since Infitah, religious and civil society collectives could mobilize well against the Mubarak regime. The millions of Egyptians left without formal social safety nets, a generation removed from the working-class stresses of Infitah, were no longer convinced of their benefits under such reforms. With food prices rising in the wake of the 2008-09 Financial Crisis and its international effects, the government failed to effectively respond with whatever limited jurisdiction it still had over the economy. Though by that point, the informal economy provided the majority of Egyptian work. The government was eager to let it live, without realizing the extent of their loss of control over socioeconomic variables in Egyptian society. With the onset of the Arab Spring, it became clear that the government had lost its grip on political control as well.

2014-Present: The Virus.

Egypt’s modern era under President Abdel Fattah el Sisi has offered new horizons for international investment, as well as Egypt’s regional economic influence, in relation to the informal economy. Sisi’s hardline stance on repressing the previous Muslim Brotherhood regime had granted his regime ready investment from Saudi Arabia, the UAE and Kuwait, in addition to a restart of Egypt’s remittance inflows from the Gulf, which currently total over $40 billion US. These opportunities have seen the new regime invest in mega-infrastructure funding like the New Administrative Capital, over 3,000 new roads and a New Suez Canal, all of which has offered hundreds of thousands of low-skilled workers employment, whether fully legitimate or publicly subcontracted to firms operating in the informal economy (Soliman). When the 2014 oil crash dried up remittance inflows from the Gulf, and Egypt’s tourism industry took a hit after the downing of a Russian passenger plane in 2015, real growth in Egypt’s two most important foreign currency streams was on the rocks. Much in keeping with historical Egyptian neoliberal tendencies, Sisi acquired a $12 million loan from the IMF to sustain growth. The regime had to gradually repeal food and fuel subsidies, raise taxes, end state hiring and erase currency controls. With slower inflation and a smaller deficit, however, much of the regime’s early socioeconomic progress was erased: millions fell below the poverty line, inducing a third of all Egyptians to depend on informal income streams, including those who did not work. Whereas Egyptian tax revenue had peaked at 25% of GDP in 1977, as EzzEldeen notes, by 2015 it had fallen to simply half that. Under Sisi’s new regime, it became evident by 2014-15 that international circumstances rooted in oil price shocks and the vicissitudes of tourism revenue in developing countries prompted domestic reforms that helped expand the informal economy at that time.

With the COVID-19 pandemic and its associated drop in oil prices, remittance inflows have once again followed them down. Protests over food and fuel price increases have followed, and coupled with tourism’s failure to near pre-1950s visitation levels in 2020, millions of jobs have been lost across all sectors. Remittance revenue has fallen even further in the past year due to the layoffs of five million Egyptian expats. Considering COVID-19 as an international factor beyond the Egyptian government’s control, the regime has responded with a 3% cut to interest rates and has stocked foreign exchange reserves to provide a LE 100-billion stimulus package. Referring to the earlier statistic of the rough 85% of Egyptian SMEs operating informally, the government announced an LE 500 per month stipend for informal labour at the pandemic’s outset. This policy would work fine, however, if the government had actually devised a system for tracking the full extent of informal labour, and if LE 500 per month was greater than the average salary of an informal worker to begin with. With international circumstances such as the pandemic toppling the growing remittance and tourism sectors, prompting domestic economic policy as state subsidies to these and other reeling industries, specific data on how the informal economy will expand to meet popular demand for public services is still being tabulated. Though if history has taught us one thing, it is that the informal economy in Egypt will find new and even more extensive ways to permeate the fabric of everyday life.

Conclusion: Still Underground.

At the end of every day, from the factories to the farms of Egypt, from the rough hands of its construction labourers to the empty kitchens of its street vendors, its workers come home exhausted. While they will not be taxed for what they made today, it is not unreasonable to think that many yearn for life under a regime that steps up as the primary provider of social services for its lower classes. Many are old enough to remember the original Infitah reforms in the 1970s, or too young to have known any role the state had in provision prior. Regardless of their status, each of them knows that they must do what they do, every day, for their own benefit and that of their families and communities. For in Egypt, the same domestic economic policy that causes state retreat from social services and an expansion of the informal economy has historically been a key outcome of dire international political and economic circumstances, and their effect on this country of some 100-odd million. From ‘67 and ‘73 war-era inflation to the international banking imperatives that led to a massive repeat of publicly-provided social services under Infitah, to further Mubarak-era reforms and downturn under Sisi, the informal economy persists and will not disappear anytime soon.

References.

EzzEldeen, Maged. "Shedding light on Egypt's shadow economy." PwC, www.pwc.com/m1/en/publications/shedding-light-on-egypts-shadow-economy.html.

Levitt, Matthew (2021). Hezbollah's Regional Activities in Support of Iran's Proxy Networks. Middle East Institute.

Mabrouk, M. F. (2020). Egypt’s sizeable informal economy complicates its pandemic response. Middle East Institute.

Peterson, Spike V. “Gendered Informal Economies in Iraq”, Ch.1 in in Nusair et al., Women and War in the Middle East: Transnational Perspectives, Zed Books, London, 2009.

Schechter, Relli. "The Cultural Economy of Development in Egypt: Economic Nationalism, Hidden Economy and the Emergence of Mass Consumer Society during Sadat's Infitah." Middle Eastern Studies, 2008, https://doi.org/10.1080/00263200802120632.

Soliman, Mohammed. "Egypt's Informal Economy: An Ongoing Cause of Unrest." Columbia/SIPA Journal of International Affairs, 29 Oct. 2020, jia.sipa.columbia.edu/egypts-informal-economy-ongoing-cause-unrest.

Vuletin, Guillermo Javier. "Measuring the Informal Economy in Latin America and the Caribbean." International Monetary Fund Working Papers, 2006.

Weinbaum, Marvin. "Egypt's Infitah and the politics of US economic assistance." Middle Eastern Studies, 2004, https://doi.org/10.1080/00263208508700624.